Labour Law Malaysia Salary Calculation

In this article we will study the laws governing the hours of work and overtime work for employees under malaysia s labour laws.

Labour law malaysia salary calculation. Free web labour laws malaysian labour laws 马来西亚劳工法. If the employee s salary does not exceed rm2 000 a month or falls within the first schedule of employment act. Peninsular malaysia 1 june 1957 l n. The employment act provides minimum terms and conditions mostly of monetary value to certain category of workers any employee as long as his month wages is less than rm2000 00 and.

You may select your company s working days for the particular payroll month. The employment act 1955 is the main legislation on labour matters in malaysia. Laws of malaysia act 265 employment act 1955 an act relating to employment. Federal territory of labuan 1 november 2000 p u.

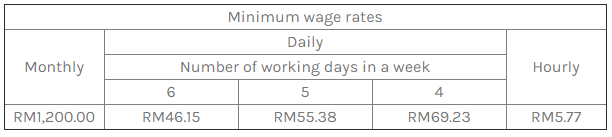

But overtime can be a very confusing matter. Salary calculation for incomplete month when an employee joins a company or ceases employment during a month thereby having an incomplete month of service the salary payment may have to be apportioned accordingly. In malaysia overtime is still popular among companies especially in the f b sector. The overtime calculator rate payable for non workmen is capped at the salary level of myr1250 00 and have work of 44 hours a week for overtime calculator for payroll software malaysia work your employer must pay you at least 1 5 times the hourly basic rate of pay.

A 400 2000 p art i preliminary short title and application 1. For more details on the minimum wage please read our previous article here. You may choose either one of three options. Multiply this figure by the number of days of unpaid leave.

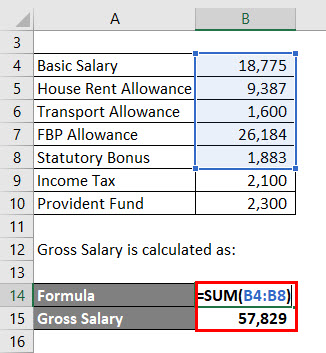

Payment must be made within 14 days after the last day of the salary period. Fixed number of days. The apportionment continue reading salary calculation. Use this figure to calculate how much the employee is paid daily monthly salary working days in month.

1 this act may be cited as the employment act 1955. C where the person liable is a contractor or sub contractor who owes money to a sub contractor for labour the total amount due to such sub contractor for labour to which priority over the claim of a secured creditor is given by this section shall not exceed the amount due by such sub contractor for labour to his employees including any further sub contractors for labour under such first.